In today’s discussion, we delve into the realm of Canada Child Benefits. If you’ve SIN (Social Insurance Number) in hand, the next step is to explore and apply for the Canada Child Benefit (CCB). This financial assistance is designed for families with children under the age of 18 and is provided by both the federal and provincial governments.

Table of Contents

Canada Child Benefits – Application Process

To initiate the application process, head to one place – the Canada Revenue Agency (CRA) website. Find the following Forms

- Form RC 66E : CCB Application Form

- Form RC 66 SCH : Status in Canada & Income

fill in the necessary details, and submit it.

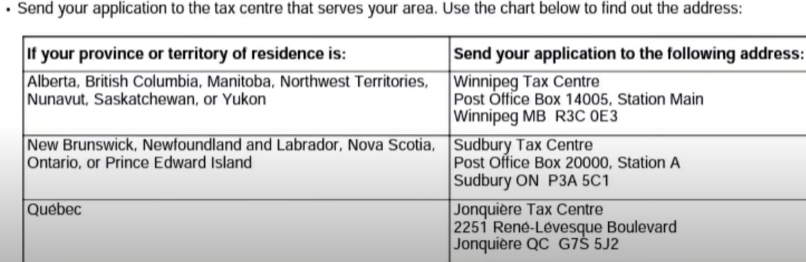

If you’re residing in Ontario, send it to the Sudbury Tax Centre Office in Toronto. Remember to include your two proofs of identity when mailing the documents to the Canada Post office.

Expert Tips for a Smooth Application

If you’re a family of three or more, ensure all members, including children, have CoPR (Parents & Kid), valid passports and the child’s birth certificate.” While filling out the forms, keep in mind that mother should be the Primary Applicant as the Child Care Benefit is directly deposited into the account linked to the primary caregiver.

Determining Eligibility and Benefit Amount

Wondering how much you’ll receive?

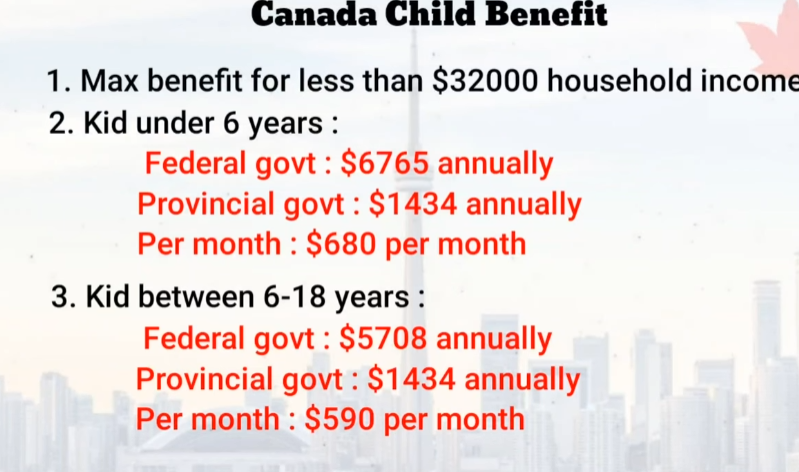

If your household income is less than $32000 per Year

a) If your kid is under 6 years:

You are eligible for the maximum benefit. The federal government contributes approximately $6765 per child annually, while the provincial government supplements around $1434 per year. You will get around $680 per month.

b) if your kid is between 6-18 years :

The federal government contributes approximately $5708 per child annually, while the provincial government supplements around $1434 per year. You will get around $590 per month. You can also use the online CCB calculator to estimate your benefits.

GST/HST forms

Alongside the Canada Child Benefit, you need not to apply for GST (Goods and Services Tax) and HST credit. Because when filling out the RC66E form, there is clearly mentioned that this is a common form ensure you don’t miss the Common Form for CCB and GST/HST credit.

Patience Pays Off

Keep in mind that the processing time for CCB applications is around 11 weeks. Once the CRA receives your application, they embark on an 11-step process, ensuring all details are accurate before proceeding. So, be patient; the benefits will come through.

FAQs – Canada Child Benefit

1. What is the Canada Child Benefit (CCB)?

The Canada Child Benefit (CCB) is a financial assistance program provided by the Canadian government to support families with children under the age of six. It aims to help parents with the costs of raising children.

2. How do I apply for the Canada Child Benefit?

To apply for the CCB, visit the Canada Revenue Agency (CRA) website and obtain the CR form. Fill in the required information and submit the form to the CRA office. Ensure you include the necessary documents, such as proof of identity and your child’s birth certificate.

Also Read

- 116 Pure Tamil Baby Boy Names: A Rich Heritage

- Inaya Name Meaning in Urdu: عنایا – 10 Best Facts

- Hamza Name Meaning in Urdu: 10 Best Facts

- Atharv Name Meaning: 10 Best Facts

- Arhaan Name Meaning in Urdu: 5 Best Facts

3. What documents are required for the application?

When applying for the CCB, you will need valid passports for all family members and the birth certificate of your child. These documents are crucial for processing the application and ensuring the benefit is deposited into the correct account.

4. Is there an income threshold for eligibility?

Yes, households with a daily income of less than $320 are eligible for the maximum Canada Child Benefit. The benefit amount may vary based on the specific circumstances, and you can use the online CCB calculator to estimate your entitlement.

5. How long does it take for the Canada Child Benefits application to be processed?

The processing time for CCB applications is approximately three months. The Canada Revenue Agency follows an 11-step process to ensure accuracy before approving the benefit.

6. Can I apply for additional benefits alongside the Canada Child Benefits?

Yes, consider applying for the Goods and Services Tax (GST) credit alongside the CCB. When filling out the RC6 form, be sure not to overlook the Common Form, which includes information on the GST credit.

7. What if I have questions or need assistance during the application process?

If you have any questions or need assistance, feel free to drop a comment on the relevant platform or reach out via Instagram. The goal is to assist and resolve any queries you may have regarding the application or benefits.

8. Is there ongoing support after receiving the Canada Child Benefits?

Yes, ongoing support is available. The commitment is to continue providing assistance and addressing concerns even after the benefit is approved. Your journey to securing government assistance is supported throughout the process.

9. When can I expect to receive the Canada Child Benefit payments?

Once your application is approved, you can expect to receive the Canada Child Benefit payments on a regular basis. The frequency of payments may vary, and you will be notified of the specific schedule.